We shouldn’t get distracted from the IRS leak scandal

Written by Luck Wilson on October 18, 2021

What ever occurred to the IRS leak scandal?

Within the information cycles typical of the social media period, breakfast’s outrages are usually lunchtime’s outdated information. Manufactured scandals are America’s most plentiful pure useful resource, and there’s usually one other one coming your manner on the hour. If any savvy spinmeister desires to maintain a narrative alive for greater than half a day, it is perhaps finest to provide it to Kyrie Irving or Nicki Minaj’s eternally newsworthy friend.

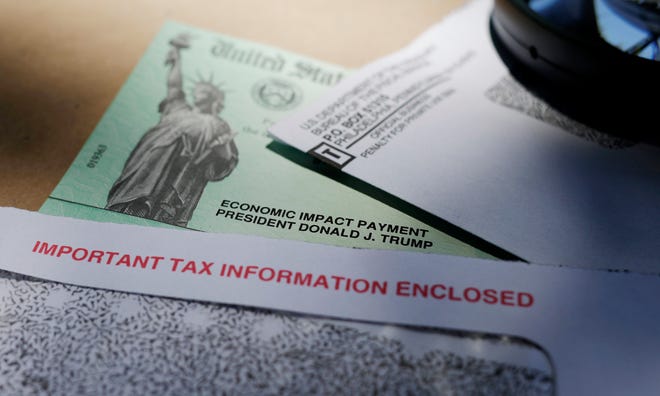

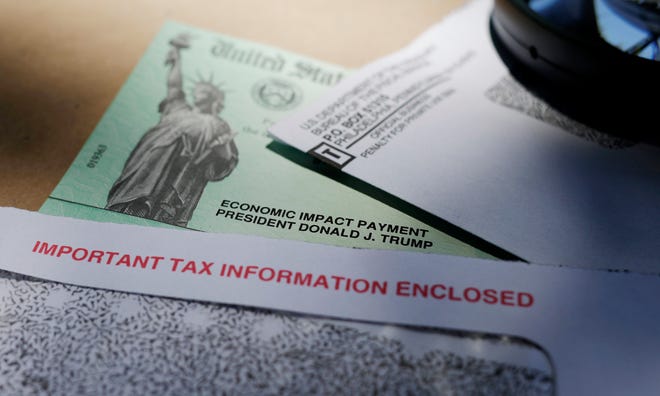

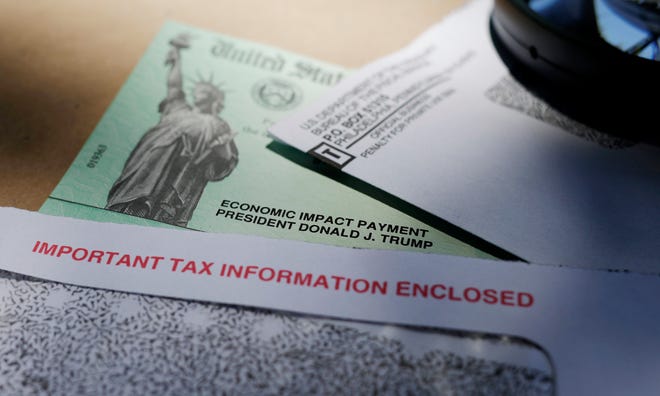

The rapid-fire scandal machine muddles our reminiscence of true outrages that rapidly disappeared. As an example, in June, ProPublica issued a report claiming America’s wealthiest people had been underpaying their taxes, based mostly on a method created by themselves to calculate wealthy people’ “true tax fee.” Solely, its report was based mostly on Inner Income Service data leaked to the publication by a supply for whom ProPublica claimed to haven’t any figuring out data.

A severe system of inequity

The response to the story was swift.

“Any unauthorized disclosure of confidential authorities data by an individual with entry is against the law, and we take this very critically,” mentioned White Home spokeswoman Jen Psaki.

“Individuals are entitled, clearly, to the best privateness with respect to their tax returns,” mentioned U.S. Legal professional Basic Merrick Garland, including, “I very nicely bear in mind what President (Richard) Nixon did within the Watergate interval – the creation of enemies lists and the punishment of individuals by means of reviewing their tax returns.”

“This was a really severe state of affairs,” mentioned Treasury Secretary Janet Yellen, vowing to unravel it.

“Belief and confidence within the Inner Income Service is kind of the bedrock of asking folks and requiring folks to offer monetary data,” mentioned IRS Commissioner Charles Rettig.

Zimmerman:Good for enterprise: Why house owners of small corporations assist greater taxes on the rich

However some progressives wanted solely the size of 1 morning bathe to scrub away their emotions of guilt to pounce on the chance to specific anti-rich sentiment. Democratic Sens. Elizabeth Warren of Massachusetts and Sheldon Whitehouse of Rhode Island despatched a letter to Finance Committee Chairman Ron Wyden of Oregon asking for a listening to on the “deeply troubling allegations” within the ProPublica report.

“This report ‘demolishes the cornerstone fable of the American tax system: that everybody pays their justifiable share and the richest Individuals pay essentially the most,’” Warren and Whitehouse wrote, quoting the report.

However for these keen to be sincere about how wealth and taxation works, the exposé itself was a dud. ProPublica tried to reverse engineer a scandal by conflating two piles of cash which are taxed in another way: “earnings” and “wealth.”

Max Baucus:We have to increase taxes, however do it pretty. And go away current Roth IRAs alone.

The online price of many “billionaires” is tied up in possession of their enterprise – their wealth exists totally on paper and will probably be realized solely on the time they determine to promote their possession. Many “wealthy” folks acquire little or no in annual earnings, though their internet price stays excessive as a result of worth of their belongings – shares, properties, and many others.

And naturally, as with most investments, the price of these belongings can go up or down. A “wealthy” one who invested all their cash in Theranos blood machines a number of years again is now possible giving their very own blood on a weekly foundation to scare up additional money.

Discovering the leaker

Additional, the companies these people create generate wealth – and thus tax income – in quantities that by no means would have materialized had they not taken on the danger and initiative to do one thing new. With out the earnings taxes and gross sales taxes generated by some main company giants, as an illustration, governments could be possible gasping for brand spanking new income sources.

And, after all, contra Rep. Alexandria Ocasio-Cortez’s conversation-starting Met Gala gown, the wealthy are taxed in America. The highest 3% of wage earners in America pay greater than 50% of the taxes in America; in the meantime, the underside 50% of wage earners pay practically 4% of the nation’s taxes.

Like a financial institution robber who pulls of a serious heist solely to understand he has stolen a truck filled with Michael Bolton’s “Best Hits” albums, the ProPublica story was possible made doable by a prison act with underwhelming outcomes.

It must be famous that the ProPublica leak is totally different than the latest “Pandora Papers” leak, through which over a dozen monetary corporations leaked details about how rich folks usually (legally) protect their belongings in overseas nations. In that case, it was non-public firms doing the leaking – though the precept is identical. No matter your earnings, would you need your private data surreptitiously handed to the general public?

Maybe, true to his phrase, Merrick Garland’s Division of Justice is working arduous to seek out the presumed IRS leaker (I contacted the DOJ to seek out out and acquired no response).

Or possibly, like 1000’s of different scandals, this one has light into historical past.

Christian Schneider is a member of USA TODAY’s Board of Contributors. Comply with him on Twitter: @Schneider_CM

The post We shouldn’t get distracted from the IRS leak scandal appeared first on Correct Success.

![Download your Women of Color Expo Seminar Schedule here! [FREE TO ATTEND] Download your Women of Color Expo Seminar Schedule here! [FREE TO ATTEND]](https://kvsp.com/wp-content/uploads/2024/04/businesswoman-making-presentation-at-conference-2023-11-27-05-15-58-utc-1024x683.jpg)